Fintech has emerged from rapid technological innovation and a new generation of entrepreneurs interested in and understanding finance.

Another major factor that has fueled innovation in this industry is the idea of improving customer experience and addressing various borrower pain points. Traditional banks rarely service these. Fintech pioneers noticed that there were gaps in the market, which led to an ever-growing lending market that caters to the needs of smaller borrowers.

Fintech is changing the financial world one innovation at a time, from insurance underwriting to simple online account opening processes to credit profiling in novel ways. Here are the top ten innovations in this industry:

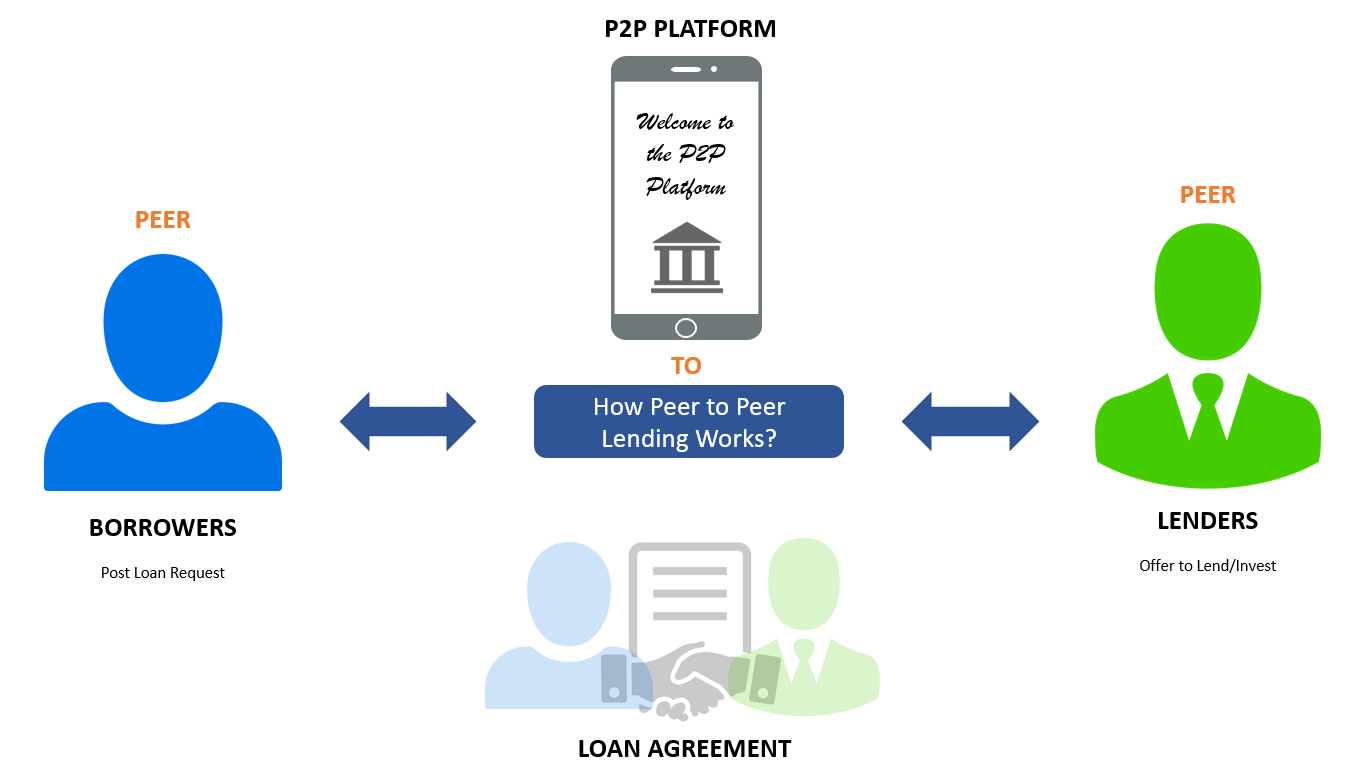

Peer-to-peer lending (P2P)

This is the best example of a win-win situation for both lenders and borrowers through the use of a technology platform. Borrowers can obtain finance from many individuals through peer-to-peer lending.

When compared to traditional banks, the loan application process is simpler. Lenders on these platforms are typically investors wishing to park their savings and investments in a place that gives higher returns than the interest rates available in traditional loan markets.

The platform does all background checks and pre-approvals for borrowers, making it easier for lenders to find the right person.

A similar mechanism underpins peer-to-business (P2B) lending. In this example, individual borrowers are replaced by businesses that borrow from a network of lenders on the platform. These lending platforms connect borrowers with lenders and charge a fee based on how much the borrowers pay back.

Alternative credit scoring

Using traditional credit rating techniques, small enterprises and self-employed individuals would not qualify for loans. Their rigorous and out-of-date credit score standards would only qualify large, well-established corporations for loans or individuals with fixed-income jobs who could provide a salary slip to back their loan application. As a result, small business owners and small businesses were having a hard time getting money because of the way traditional credit rating methods worked.

The fintech industry saw a need for more flexible and qualitative scoring, which could be used in these situations to ensure that credit score analysis was done correctly. For example, percentile credit scoring can be used to ensure that credit score analysis is done correctly. Another novel feature utilized to give a variable credit rating is social signals. This, along with deep learning algorithms, has led to better loan decisions for fintech over time.

These credit scoring algorithms have also brought down the cost of underwriting loans, allowing fintech companies to pass on their savings to borrowers and therefore expand their client base.

Small ticket loans

Due to the poor profits and high underwriting fees on small price loans. As a result, consumers who want to buy big-ticket items and high-priced white goods often have difficulty financing their purchases. Fintech lending firms have spotted this need and are increasingly serving borrowers through BNPL products.

These “Buy Now, Pay Later” funds let consumers purchase things in the press of a mouse without filling out lengthy loan applications or waiting for approval. What’s more, these loans are underwritten at 0% interest with the option to pay in installments.

Fintech companies that supply these finance options pass on this customer data to Original Equipment Manufacturers (OEMs), who stand to benefit the most from the increasing affordability of their products.

When customer data is filtered by machine-learning and deep-learning algorithms, OEMs gain insights that allow them to launch highly customized offers in the market. As a result, the 0% interest component provided by these fintech lenders is funded by the OEMs who purchase the information from them.

Alternative insurance underwriting

In traditional insurance underwriting, incorrect premium estimates have become the standard. People of the same age, height, and weight and teetotalers will be allocated the same insurance premiums in these instances.

However, the premiums do not consider other qualitative characteristics such as these people’s health routines and exercise behaviors. Two people who apply for insurance may be charged different rates based on more qualitative aspects of their health.

For example, one could be a fitness fanatic while the other is a junk-food-eating couch potato. Needless to say, the latter’s health concerns would be more acute and severe.

Alternative insurance underwriting accounts for these subtle variances by collecting information based on medical history, lifestyle, and social signals.

This enables them to remove normalization in actuarial terms, which produces erroneous findings when using traditional underwriting procedures. This data, along with algorithms and analytics, allows fintech companies that sell insurance products to give applicants very personalized insurance rates and payment options based on their needs and qualifications.

Transaction delivery

In the age of big data and IoT, it is expected that tech firms will collect as much data as possible to fuel their functions and follow-up expansions. After all, it is only through researching previous data and making forecasts based on it that businesses can develop new strategies and develop better products.

Data provides fintech organizations with vital insights into what their clients genuinely require.

Fintech companies collect this information through free digital goods such as cost management apps. These apps capture useful information about a customer’s willingness to pay premiums, purchase mutual funds, or invest in real estate. Companies sell this data and insights into third-party financial products in exchange for a commission on sales.

Digital wallets

The digital wallet has transformed payments worldwide, going beyond paper and conventional money. These wallets function as both a “no-frills” bank and a payment gateway. This technology allows users to put virtual cash into their digital wallets and use it for both online and offline transactions where merchants accept digital wallet payments.

Consumers can use digital wallets to make payments more convenient. They generate cash by charging a small fee to retailers. Consumers and stores that offer their products and services to these consumers are the most common end-users of wallets.

Digital banking

Digital banking is the digitalization of traditional banking. Digital banks are distinguished by their entire digital presence, which is devoid of any physical headquarters or branches.

They operate in the same way that traditional banks do, but they are no-frills service providers with an end-to-end digital infrastructure. The money they save by not having to hire people and buy land is passed on to their customers, which is a big win for both digital banks and their customers.

Payment gateways

With the development of e-commerce, merchant sites’ requirements for secure payment gateways have grown exponentially. Payment gateways allow customers to make purchases on e-commerce sites using a variety of payment methods.

Customers can make payments using debit and credit cards, bitcoins, and digital wallets. Traditional banks usually charge a lot of money to use any of these other payment methods, which makes them uneconomical for businesses to use.

Fintech companies use technology to make apps and payment gateways that are easy for people to use and that can be easily added to their websites.

Digital Insurance

Digital insurance is the last but not least of the top ten innovative fintech solutions. As the name implies, digital insurance relies heavily on digital infrastructure and faster underwriting processes.

Alternative insurance underwriting has enabled these fintech insurance companies to provide better and less expensive coverage for house and life insurance policies while pricing premiums based on qualitative rather than quantitative variables. This has also led to a lot of business opportunities for the fintech insurance industry.

The fintech industry is just getting started in the financial services market, with many funding alternatives and solutions and many more innovations along the way.

The industry has undoubtedly found its niche by challenging traditional funding techniques and providing personalized solutions while achieving revenue requirements through creative methods and integrating the two behemoths of finance and technology.

Asset management

Fintech-based asset management allows investors to build portfolios by purchasing equities and mutual funds without having to pay a commission fee. Although the assets they purchase are slightly higher in price than the actual asset price, the amount of money they save by not paying commission fees makes the investment benefits and the asset price positive.

Asset management firms can accomplish this by gathering investor data in exchange for a waiver of the commission cost. They share this information with high-frequency traders who have the ability to influence asset prices.

How will these changes affect the fintech industry?

Seven 3 important technologies will drive business model reinventions while changing the competitive environment of the financial industry over the next ten years.

Technological advancement and innovation are the bedrock of fintech development and will continue to drive disruptive business models in financial services. Over the next decade, three main technologies will drive financial services software development and set the rules for the business of finance.

AI – Massive value creation will be driven by artificial intelligence.

Automatic factor discovery, or machine-based identification of elements that drive outperformance, will become increasingly common in financial services, aiding in the refinement of financial modeling across the sector.

Knowledge graphs and graph computing will also play a larger role in the crucial application of AI semantic representation. Using a wide range of data sources can help make connections and find patterns in complex financial networks. This will have a big impact on the world in the coming years.

Finally, analytics with better privacy safeguards will encourage minimum data utilization, or the use of just relevant, essential, and suitably cleansed information, in the training of financial models.

These include federated learning, a type of decentralized machine learning that solves the privacy risk associated with centralizing datasets by bringing computational capacity to the data rather than the other way around.

It will be easier for people to keep their personal information safe thanks to new encryption techniques, safe multi-party computing, zero-knowledge proofs, and other privacy-conscious data analysis techniques.

AI applications will permeate the whole financial industry’s operations, including front, middle, and back offices. Tailor-made products, personalized user experience and analytics services, intelligent service robots and chat interfaces, enhanced by text classification for improved customer interaction, market trackers, automated transactions and robot-advisors, alternative credit ratings based on non-financial data, and facial recognition authentication are examples of customer-facing applications.

Knowledge graphs, natural language processing, and smart procedures are examples of applications in the middle and back-office that help people do their jobs more efficiently.

Many financial institutions continue to deploy AI in a haphazard and dispersed manner, frequently limiting the technology to specific use cases or verticals. However, leaders in the banking industry are revolutionizing their operations by systemically applying AI throughout the whole lifecycle of their digital operations.

Notably, the financial industry realizes that algorithms are only as good as the data they are fed. The focus is shifting to acquiring a competitive advantage from previously underutilized customer behavior data obtained through traditional operations.

This will open up the previously untapped potential of ecosystem-based financing, which is when banks, insurers, and other financial service organizations work together with non-financial businesses to provide seamless customer experiences in areas where they don’t normally work.

For banks, becoming an “AI-first” institution will result in increased operational efficiency through the extreme automation of manual operations (a “zero-ops” mindset) and the replacement or augmentation of human choices with sophisticated diagnostics.

The improved operational performance will result from the widespread use of traditional and cutting-edge AI technologies like machine learning and facial recognition for (near) real-time analysis of massive and complex customer data sets.

Future “AI-first” banks will emulate the speed and agility enjoyed by “digital native” companies and users. They will innovate quickly, offering new features in days and weeks rather than months and years. Banks and non-bank partners will also work together to come up with new value propositions that cover journeys, technology platforms, and data sets, as well as how these things work together.

Cloud computing – will unleash participants in the financial services industry.

Financial organizations should be aware of three types of cloud services: public cloud, hybrid cloud, and private cloud. The infrastructure in the public cloud is owned by cloud computing service providers, who sell cloud services to a diverse range of enterprises or the general public.

Hybrid cloud infrastructure is made up of two or more types of clouds (private and public) that are maintained independently but linked by proprietary technology. A private cloud refers to infrastructure that is created for a single customer’s exclusive use and is deployable in company data centers or through other hosting facilities.

Open source, SaaS, and serverless – will lower entry barriers.

Speed and scalability are crucial for new enterprises and financial innovation, especially in the digital economy’s intense rivalry and winner-take-all dynamics.

It’s becoming more and more important for technology companies and traditional financial institutions to use open source software, serverless architecture, and software as a service (SaaS) if they want to start a new business in fintech.

SaaS allows companies to use the software (such as Scaleo’s affiliate marketing software) as needed without owning or maintaining it, whereas serverless architecture eliminates the need for businesses to run their own servers, freeing up time and resources for customers and operations.

The serverless design also saves money because charges are tied to executed software code rather than being created around the clock, independent of business requirements. It also promotes flexible scaling, which reduces idling and losses while increasing development efficiency. Open-source software is a lifesaver for companies trying to scale quickly since it provides free-to-use source code that enables developers to get a head start in developing their own apps.

Conclusion

These major technologies and trends are increasingly linked and integrated, providing significant impetus to fintech and financial industry innovation. As things are, it is a niche financial service.

Sub-sectors that excel at leveraging technological advancements to develop apps, create value, and alter the competitive landscape of traditional financial institutions will need to marshal their vast resources in the future to stay ahead of the looming tsunami of financial industry disruption.

Looking to add an affiliate program to your fintech solution? Try Scaleo free for 14 days or schedule a demo call today and see how it can transform your business.

Last Updated on March 26, 2024